Table of Contents:

Understanding HTS Codes for Steel Products

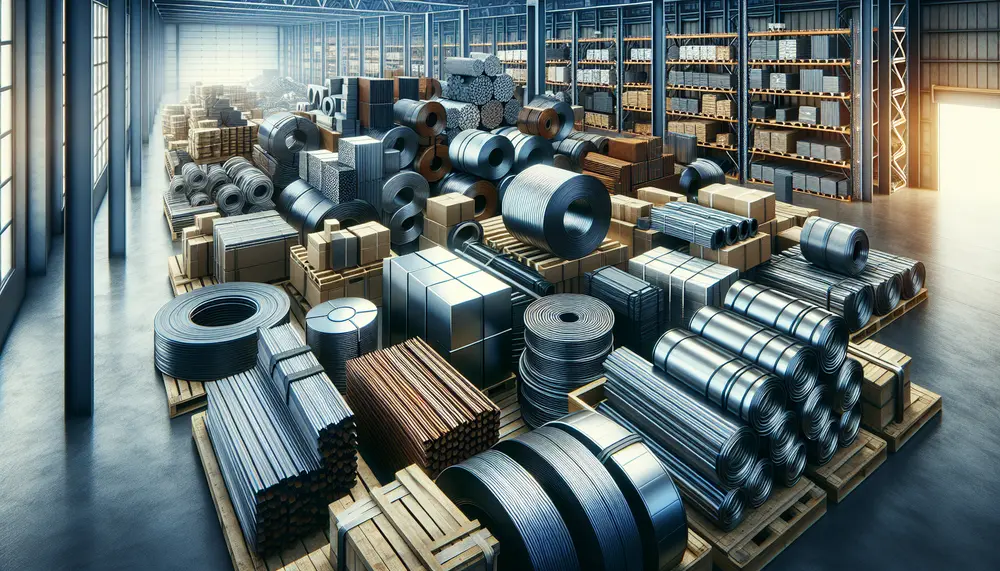

The world of international trade is intricate and detailed, with a myriad of regulations and classifications that ensure the smooth exchange of goods across borders. One key aspect of this global marketplace, especially when it comes to steel products, is understanding Harmonized Tariff Schedule (HTS) codes. HTS codes are a standardized numerical method of classifying traded products. They are used by customs authorities around the world to determine the tariffs, duties, and taxes that should be applied to each imported or exported product.

When delving into the realm of steel products, HTS codes become indispensable. Each variation of steel, whether it be stainless, alloy, or coated products, comes with its unique code that precisely defines its characteristics. These codes not only categorize the type of steel but also contain important information about its uses and the country-specific regulations that may apply to it.

For businesses involved in the production, exportation, or importation of steel goods, a correct understanding of the corresponding HTS codes is necessary to prevent costly delays at customs. It helps in evaluating trade agreements and determining whether a product qualifies for a preferential tariff rate. Staying updated with HTS codes is vital because they are subject to change based on international trade negotiations and policy changes.

Using HTS codes, traders can accurately and effectively communicate the specifics of their product offerings. They also help in compiling trade statistics that assist in forecasting market trends and making informed decisions. To navigate through the complexities of HTS classifications, companies often employ experts or train their staff extensively, underlining how pivotal these codes are to the everyday workings of steel trade.

The Basics of Harmonized Tariff Schedule Codes

Harmonized Tariff Schedule (HTS) codes form the foundation of the modern trade classification system. These codes are based on an internationally agreed-upon system known as the Harmonized Commodity Description and Coding System, or simply the Harmonized System (HS). Developed and maintained by the World Customs Organization (WCO), the HS is an intricately organized code that allows for consistent classification of goods on a global scale.

At their core, HTS codes are composed of a series of numbers, each set representing a specific category of goods. Typically, an HTS code can be anywhere from 6 to 10 digits long. The first six digits are an international standard across all countries adhering to the HS, while the additional digits are country-specific, providing further detail and allowing countries to impose their individual tariffs and policies.

The initial two-digit chapter identifies the broadest category of goods, followed by two more digits that define the heading for a closer grouping of products. The subsequent subheading, with an additional two digits, narrows down the classification further, identifying a specific item or a range of items within the heading. The final digits in the country-specific part of the HTS code offer the highest level of detail, even distinguishing between different grades or qualities of the product.

For steel products, the HTS code can convey critical information such as the type of steel, its form (e.g., coils, sheets, bars), and any treatments it has undergone (e.g., coated, plated). Businesses within the steel industry must familiarize themselves with these codes to correctly classify their merchandise for shipping and compliance, but also to capitalize on potential tariff reductions where trade agreements are in place.

Navigating the HTS Code System for Steel Goods

Navigating the HTS code system for steel goods requires a strategic approach due to the complexity and specificity of the codes. Trade professionals must ensure meticulous attention to detail when determining the correct HTS code for each steel product. One minor misclassification can lead to significant delays and additional costs in the supply chain.

To start with, obtaining the precise HTS code for a steel product involves examining its physical characteristics and intended use. This information aligns with the descriptions provided in the HTS manual, which lists the codes in a systematic and hierarchical fashion. Adequate training or the use of specialized software tools can assist in streamline this multistep classification process.

It's also essential to stay informed about any updates or revisions to the HTS codes. Changes can occur due to international trade agreements, alterations in regulations, or shifts in industry standards. Regularly checking official government websites, such as those of customs or trade administrations, helps in receiving timely updates about any adjustments in HTS codes for steel products.

Moreover, understanding the implications of HTS codes goes beyond compliance. A correct understanding of these codes can reveal insights into trade data analysis, competitiveness on a global stage, and strategic planning for market expansion. Therefore, professionals within the steel industry often engage in ongoing education programs or partnerships with customs brokers to effectively manage the HTS code system.

Key Benefits of HTS Codes in Steel Trade

HTS codes provide multiple benefits within the sphere of steel trade, serving not just as a tool for legal compliance, but as an enabler of international business efficiency and strategic insight. These codes are vital cogs in the engine of global trade, facilitating a number of key operations and strategic decisions.

Foremost amongst their benefits is the role HTS codes play in streamlining tax and duty assessment. By providing a clear description of goods, these codes allow for the accurate and expedited calculation of tariffs, helping to avoid disputes with customs authorities and speeding up the clearance process. This precision in classification ensures that steel traders can anticipate and budget their costs more effectively.

Another significant benefit of HTS codes is their capacity to promote fair competition. They help create a level playing field where trade protections can be applied consistently, and anti-dumping duties enforced, to protect domestic industries from unfairly priced foreign imports. Such measures are essential to the health and sustainability of local steel markets.

Additionally, HTS codes are integral to benefiting from free trade agreements (FTAs) and preferential tariffs. Steel traders utilizing these codes can identify when their products are eligible for reduced tariffs under FTAs, providing them with a competitive edge in participating markets and improving profit margins.

Finally, HTS codes contribute to a reliable database for trade statistics, essential for policy-making and market analysis. This data is invaluable for identifying trends, evaluating demand for different steel products, and making informed decisions regarding production and investment.

How to Find the Right HTS Code for Your Steel Product

Finding the right HTS code for your steel product is a critical step to ensure that your goods move smoothly across international borders. To do this, one must follow a methodical approach that takes into account the unique attributes of their product.

Begin with a detailed product analysis. Collect information about the material composition, product form, and the manufacturing processes involved. This level of detail is essential since HTS codes can differ based on elements like carbon content or the method of production used in creating the steel product.

Once you have gathered this information, refer to the official HTS manual or online database. These resources provide comprehensive lists of all HTs codes, description, and notes which can help guide you to the correct classification. It's often advisable to start by identifying the broader categories that your product seems to belong to and gradually narrow down the options.

If uncertainties remain, consider consulting with a customs broker or using specialized software. Customs brokers are experts in product classification and can provide valuable assistance. On the other hand, classification software can analyze product descriptions and suggest possible HTS codes through algorithms.

In cases where ambiguity persists, requesting a ruling from customs authorities can be beneficial. A binding ruling will provide legal certainty about the correct HTS code for your product, protecting against misclassification errors.

Remember, errors in HTS classification can lead to delays, fines, and even seizure of goods, so it's imperative to allocate sufficient time and resources to identify the right HTS code for your steel product. Maintaining a database of HTS codes for products you regularly trade in can streamline this process for future shipments.

Common HTS Codes for Steel Products and Their Meanings

For individuals and businesses involved in the steel trade, it's useful to familiarize oneself with some of the common HTS codes that pertain to steel products and understand their meanings. These codes help in discerning the different types of steel goods and are crucial for correct classification when trading internationally.

For instance, one widely recognized code is HTS 73269094, which corresponds to an array of fabricated steel items that are not elsewhere mentioned or included in the trade tariff manual. This broad classification can encompass a diverse range of steel products, often finished goods or parts for machinery.

| HTS Code | Product Description |

|---|---|

| 7206 | Iron and non-alloy steel in ingots or other primary forms |

| 7213 | Bars and rods, hot-rolled, in irregularly wound coils, of iron or non-alloy steel |

| 7219 | Flat-rolled products of stainless steel, of a width of 600mm or more |

| 7302 | Railway or tramway track construction material of iron or steel |

| 7304 | Tubes, pipes and hollow profiles, seamless, of iron (other than cast iron) or steel |

Understanding these code descriptors is essential in the classification process. For example, HTS code 7219 is specific to flat-rolled stainless steel products, which tells traders this code is not applicable to products such as steel rods or tubes, which are designated with their unique codes such as 7213 or 7304 respectively.

While there are many HTS codes related to steel, the nuances in the product description can significantly affect the duty rate and trade compliance. It's imperative for steel traders to invest in accurate HTS code understanding to optimize trade operations and adhere to international trade laws.

The Role of HTS Codes in International Steel Trade

HTS codes fulfill an integral role in facilitating efficient and compliant international steel trade. They act as a universal language that customs officials and traders worldwide use to identify products and manage the complex processes of import, export, and tariff application.

The systematic use of HTS codes in documentation and shipping manifests enables authorities to quickly process and clear shipments. These codes communicate the necessary details that determine import eligibility, duty rates, and the need for specific permits or inspections. Adherence to the correct usage of HTS codes minimizes the risk of delays at ports, helps avoid the accumulation of demurrage charges, and ensures that steel products reach their destination markets in a timely manner.

Additionally, HTS codes play a pivotal role in global trade negotiations, where they are used to craft trade agreements and resolve trade disputes. Governments and trade blocs use the precise classification of goods provided by HTS codes to set terms of trade, negotiate duties, quotas, or embargoes, and establish clear-cut rules governing international commerce.

Moreover, the use of HTS codes allows businesses to gauge market dynamics. Analysis of trade data coded with HTS classifications can offer insights into global demand patterns, emerging markets, and competitive landscapes. This data-driven approach supports strategic planning and market positioning within the steel industry.

In light of these functions, the role of HTS codes extends beyond mere compliance. They are key tools that inform trade policy, market analysis, and the overall operational strategies of companies participating in international steel trading.

Deciphering the Structure of Steel Product HTS Codes

Deciphering the structure of steel product HTS codes is essential for anyone engaged in international steel trade. While the intricacies of these codes can be daunting at first, understanding their composition is critical for accurate classification and compliance.

Each HTS code for steel products is composed of a series of digits that break down the characteristics of the product in a hierarchical manner. The first two digits, known as the 'chapter number', indicate the general category of the goods. For steel products, chapters 72 and 73 are most commonly used, denoting 'Iron and steel' and 'Articles of iron or steel' respectively.

The next two digits, the 'heading number', define a subcategory within that chapter. For example, a heading of 04 under chapter 73, creating an HTS code beginning with 7304, specifies 'Tubes, pipes and hollow profiles, seamless'. This gives a clear indication of the type of steel product being classified.

Subheadings are indicated by the following two digits, which further refine the product's categorization by attributes such as the shape, alloy content, or manufacturing process. For instance, under heading 7304, a subheading of 21 would specify 'Cold-drawn or cold-rolled', identifying the specific method used to produce the steel tubes or pipes.

The remaining digits are often used for even more detailed breakdowns and can vary from country to country. These final digits reflect national amendments to the international code, allowing countries to set their custom duty rates or enforce specific trade measures for particular products.

This structured approach to classifying steel products by HTS codes not only facilitates clarity in international trade but also ensures that stakeholders can confidently navigate tariff implications, trade agreements, and accurately report on their commerce activities.

Compliance and Challenges with HTS Codes in Steel Industry

Compliance with HTS codes is a critical component of international trade within the steel industry. Ensuring that goods are properly classified can prevent costly penalties and facilitate smooth customs clearance. However, the steel industry faces unique challenges when it comes to HTS compliance due to the specialized nature of its products.

One significant challenge is the ever-evolving landscape of trade regulations. Steel products may be subject to changes in classification due to updates in international trade agreements or adjustments made by customs authorities. Companies must continuously monitor these changes to maintain compliance and avoid potential setbacks in their trading operations.

Another hurdle pertains to the granular level of detail required in HTS classification. With a wide variety of shapes, sizes, and compositions, steel products can fall under numerous HTS codes. Determining the precise code often comes down to subtle differences in product attributes, which demands a deep understanding of both steel goods and the coding system.

There is also the challenge of differing interpretations of HTS codes by various customs authorities. What might be deemed compliant in one country could be classified differently in another, leading to inconsistencies and potential trade disputes that companies must navigate carefully.

To address these challenges and ensure compliance, many companies invest in training for their staff, collaborate with experienced customs brokers, and adopt sophisticated classification tools equipped with the latest regulatory updates. By prioritizing accurate HTS code classification, the steel industry can minimize the risks of compliance issues and capitalize on global trade opportunities.

Future of Steel Trade: Trends in HTS Code Classification

The future of steel trade is inextricably linked to the evolution of HTS code classification. As the industry advances, several trends are likely to shape the way these codes are utilized and managed within the steel sector.

One such trend is the increasing digitization and automation of trade processes. With advancements in technology, businesses are starting to implement more sophisticated software solutions that can automate the HTS classification process, reducing human error and improving efficiency in customs procedures. This can lead to more consistent compliance and potentially quicker turnaround times in the logistics chain.

Moreover, there's a growing emphasis on data analytics and trade intelligence. The vast amounts of data generated through HTS code classifications offer valuable insights. By leveraging this information, companies can better understand market directions, predict trends, and adjust their business strategies to stay ahead in a competitive landscape.

Another trend is the push for greater harmonization and standardization of HTS codes at the international level. As global trade grows more interconnected, there is a need for a more unified approach to classification that reduces the discrepancies between different countries' customs regulations. This harmonization could lead to smoother international transactions and the reduction of trade barriers.

Lastly, potential changes in trade policies and international relations will continue to influence HTS codes. Trade tensions and negotiations can lead to new tariffs and trade restrictions, requiring quick adjustments in HTS code classifications. Staying informed and agile will be key for the steel industry to navigate this dynamic aspect of international trade.

These trends in HTS code classification hint at a future where technological innovation, data-driven decision-making, and international cooperation will become even more integral to the success of steel trading on the global stage.

Expert Tips for Classifying Steel Products by HTS Codes

Proper classification of steel products by HTS codes is both an art and a science. Experts in the field often share valuable tips to help navigate this complex task with greater confidence and precision.

One key tip is the importance of detailed product knowledge. Understanding the properties, such as alloy content or production method, is crucial for selecting the correct HTS code. A comprehensive understanding of your product helps to match it with the most accurate code description.

It's also recommended to consult multiple sources for HTS classification. This includes the HTS manual, trade databases, and consultation with industry peers. Gathering various perspectives can help to corroborate the correct classification and overall understanding of HTS codes for steel products.

Regular review and validation of classifications are essential. The trade environment is dynamic, and HTS codes can change. Routine checks ensure ongoing compliance and reduce the risk of encountering issues during customs inspections.

For those new to classification, or when dealing with a particularly complex product, seeking expert assistance is advisable. Customs brokers and classification specialists have the expertise and experience to navigate the subtleties of HTS codes, providing invaluable guidance and saving time in the long run.

Lastly, leveraging technology and automation tools can significantly streamline the classification process. There are state-of-the-art software solutions that help identify HTS codes, track changes, and manage documentation, which can be exceptionally helpful for businesses dealing with a large volume of international trade.

By following these expert tips, companies can enhance their HTS classification process for steel products, thereby improving efficiency, compliance, and staying competitive in the international marketplace.

HTS Code Updates and Their Impact on Steel Products

The world of international trade is not static, and HTS code updates are a testament to its evolving nature. These updates can significantly impact the classification and trade of steel products on the global market.

Changes in HTS codes can arise from technological advancements in steel manufacturing, which may create new products or alter existing ones. When such innovations occur, it may prompt the creation of new codes or revision of existing codes to accurately represent these changes.

Shifts in international trade policies or environmental standards can also lead to HTS code updates. For instance, the introduction of tariffs on certain steel products may require changes to classification codes to regulate these new measures effectively.

It's vital for those in the steel industry to actively monitor for announcements of updates from official bodies like the World Customs Organization and national customs authorities. Proactive adaptation to these changes is crucial to avoid disruptions in trade flows and ensure compliance with the latest regulations.

Moreover, companies should assess the economic implications of HTS code updates. Revised classifications could result in different tariff rates, which can affect pricing, competitiveness, and overall market strategy.

Effectively managing HTS code updates necessitates a responsive and informed approach. It requires collaboration across departments, from legal and compliance teams to supply chain management, ensuring that all segments of a business are aligned and prepared for any changes that may affect their operations.

Understanding Trade Restrictions Through HTS Codes for Steel

Steel is a commodity that is often at the center of international trade restrictions, and HTS codes are instrumental in managing these regulations. Understanding how these codes relate to trade restrictions is crucial for anyone involved in the steel industry.

Trade restrictions can come in various forms, including tariffs, quotas, and embargoes. These restrictions may be applied to protect domestic industries, safeguard national security, or respond to trade imbalances and other political considerations. HTS codes enable governments to precisely target specific steel products with these measures.

To navigate these restrictions, thorough research into the HTS codes associated with steel products is necessary. This includes understanding which steel products are subject to restrictions and the conditions under which these restrictions apply. The official trade databases and customs websites of countries are primary sources of this critical information.

TARIC, the integrated Tariff of the European Union, is a key resource for those trading within or with the EU. It provides comprehensive details on all tariffs, commercial and agricultural legislation, and import procedures, which include steel products identified with HTS Code 73269094 and other relevant classifications.

In some cases, companies may benefit from consulting with trade experts or legal professionals who can help interpret the complex web of trade restrictions associated with HTS codes. They provide guidance on optimizing tariff rates, taking advantage of trade agreements, and minimizing the risk of penalties for non-compliance.

Overall, a nuanced understanding of how HTS codes for steel relate to trade restrictions can help businesses plan, anticipate costs, and make strategic decisions about sourcing and market entry. This knowledge acts as a protective measure against the volatile nature of international trade politics.

Additional Resources for Steel HTS Code Lookup and Verification

In the realm of steel trade, accuracy in HTS code classification is paramount. To assist in this critical task, there are a variety of resources available for steel HTS code lookup and verification. Utilizing these resources can ensure greater accuracy and compliance with international trade regulations.

A key resource is the official website of the World Customs Organization (WCO), which provides a comprehensive database of the Harmonized System, including updates and amendments. The WCO's platform offers definitive guidance on HTS codes used in member countries.

The United States International Trade Commission (USITC) also hosts a searchable version of the HTS, detailing codes specific to the U.S. market. This resource is valuable for verifying the codes and understanding the corresponding duty rates and restrictions.

For trade within or into the European Union, the TARIC (Integrated Tariff of the European Union) is available online. It serves as an indispensable tool for determining duty rates, checking rules of origin, and locating other relevant measures that affect import and export.

Businesses may also turn to subscription-based services that offer HTS classification tools. These platforms often provide advanced search functions, explanatory notes, legal rulings, and real-time updates for a vast array of HTS codes, including those for steel products.

Employing the services of professional customs brokers or utilizing consultancy services can further aid in verifying HTS codes for steel. These experts remain abreast of all HTS code changes and can provide customized assistance to businesses looking to ensure precise classification.

With these additional resources, companies can validate their steel HTS code assignments with confidence, supporting their efforts to maintain seamless trade compliance and optimal operational flow in the international marketplace.

Conclusion: Mastering HTS Codes for Successful Steel Trading

Mastering the use of HTS codes is undeniably a cornerstone for success in the global steel trade. Classification accuracy can influence a company's ability to navigate international regulations, leverage trade agreements, and maintain competitive pricing.

Adherence to the correct HTS codes is not merely a matter of compliance; it's a strategic advantage. By ensuring accurate and current classifications, businesses protect themselves against fines and penalties, expedite the shipping and customs process, and better manage their international supply chains.

The significance of HTs codes transcends mere transactional utility. They provide a wealth of data that, when properly analyzed, can reveal market trends, highlight opportunities, and inform business strategies. In essence, HTS codes serve as keys to unlocking market intelligence and driving informed decision-making.

As the steel industry continues to evolve amidst changing trade policies and technological advancements, companies that invest time and resources into understanding and applying HTS codes will be well-positioned to thrive. The task requires diligence, adaptability, and a commitment to continuous learning, but the payoff is the ability to operate with confidence and precision in the complex landscape of international steel trade.

Understanding HTS Codes in the Steel Industry

What are HTS codes and why are they important?

HTS codes, or Harmonized Tariff Schedule codes, are a standard numerical method for classifying traded products. They are essential in international trade as they determine the tariffs, duties, and taxes that apply to each product, ensure compliance with trade laws, and aid in the collection of global trade statistics.

How are steel products classified under HTS codes?

Steel products are classified under specific HTS codes based on their material composition, product form, and the manufacturing processes involved. These codes are structured hierarchically to convey detailed information such as type, form, and treatments of the steel products.

Can HTS codes change and how does that affect the steel industry?

Yes, HTS codes can change due to international trade negotiations, changes in policies, or updates in classification standards. Such changes can have a significant impact on the steel industry by altering tariff rates and compliance requirements, thereby affecting international trade dynamics and market strategies.

What role do HTS codes play in trade restrictions?

HTS codes enable governments to precisely target specific products for trade restrictions like tariffs, quotas, and embargoes. They help in enforcing trade protections, ensuring compliance with regional and international trade laws, and applying anti-dumping duties to protect domestic industries.

Where can I find the right HTS code for my steel product?

The correct HTS code for a steel product can be found in official tariff databases such as the HTS manuals or online databases provided by customs authorities. Other resources include the World Customs Organization (WCO), the U.S. International Trade Commission (USITC), TARIC for the EU, and professional customs brokers or consultancy services.